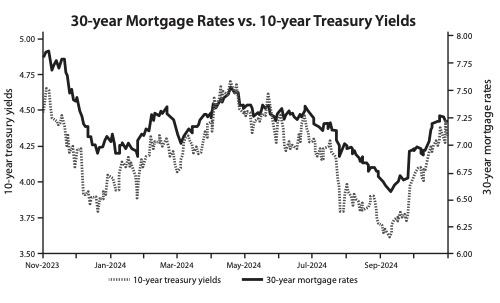

The inflation rate is closer to the Federal Reserve’s target of 2%, sitting at 2.7% as of December 2024; a significant decline from 9.1% in June 2022. The Fed cut its rates for the first time in four years on Sept. 19, 2024, from 5.5% to 4.5% on Dec 18, 2024, and signals two rate cuts in 2025. So why are mortgage interest rates still high? Thirty-year mortgage interest rates tend to trend 2%-3% higher than the 10-year treasury yield over the last five years. Many of the same investors compete for both treasury bonds and mortgages, but mortgages are higher due to their increased risk. Further, Jess Schulman, president of Bluebird Lending, indicates investors in capital markets buying mortgages need to be incentivized to purchase bonds. If 10-year treasury yields go up, so do mortgage rates, and vise versa. Unemployment, inflation and other economic factors also come into play.

From Bret Kenwell at etoro.com: “Jeffrey Gundlach, a well-known institutional bond investor, argues that there’s too much supply of Treasury bonds in the mix (remember, as bond prices go down, bond yields go up). Others have argued that a more resilient and stronger-than-expected U.S. economy has institutional investors rotating out of safe havens like bonds and into risk-on assets like stocks. Even Fed Chair Powell wasn’t able to pinpoint the reason, suggesting that perhaps it’s a ‘sense of more likelihood of stronger growth and perhaps less in the way of downside risks.’ Ultimately, it’s hard to zero in any one reason why bond yields are defying expectations. The bottom line: For now, let’s keep an eye on those yields. If they come back down, bonds will be a direct beneficiary, while sectors like utilities, consumer staples and real estate may benefit as well.”

Housing market conditions should improve in 2025, and prices likely will continue to rise as they seasonally do in spring markets. Depending on how the economy goes, combined with inflation, the Fed rate and the the 10-year treasury yields, we may only see a slight decline in mortgage interest in 2025. Demand for Metrowest real estate will remain high, thus prices will continue to rise. I encourage buyers to continue to pursue their dream house now versus waiting for the rates to come down. And remember, you can buy down a rate, and some banks will even honor a lower rate if they go down within the first year of buying a home. Once those rates do come down, the prices will go up even higher. So, marry the house, not the rate!

Kim Foemmel

Kim Foemmel

Foemmel Fine Homes

1 Lumber Street, Suite 207C

Hopkinton, MA

(508) 808-1149

Kim.Foemmel@gmail.com

FoemmelFineHomes.com

The advertiser is solely responsible for the content of this column, which is a paid advertisement.

0 Comments